No taxes for war, 2013 action by the War Resistors League, photo by All-Night Images vis Flickr Creative Commons license All-Night Images via Flickr CC / All-Night Images

And Jesus said to them, "Render to Caesar the things that are Caesar's, and to God the things that are God's." Mark 12:17

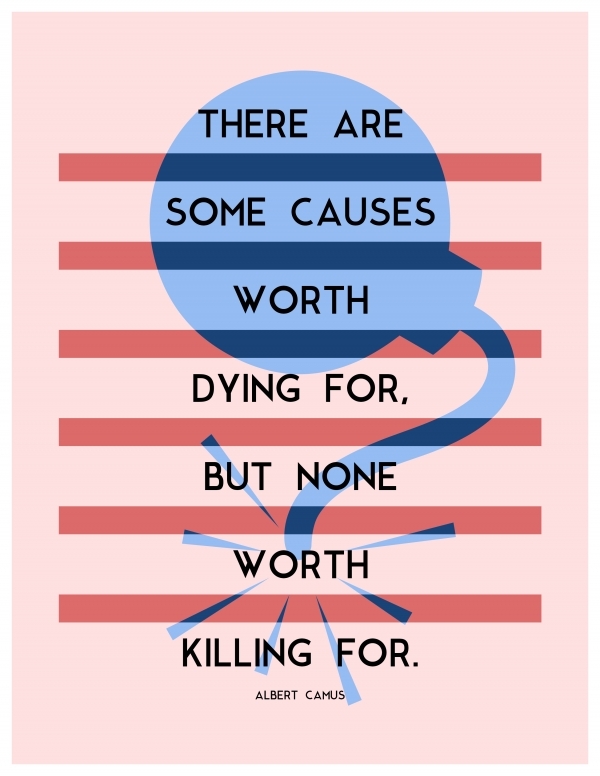

While most people have interpreted this verse from the New Testament to indicate that they are required to pay taxes to the government, I have a different interpretation. In 1961 when I turned eighteen, I applied to become a conscientious objector to military service. I did not feel that I should participate in killing other human beings. Shortly thereafter I realized that it would be hypocritical, if I was unwilling to do it myself, to pay others to kill on my behalf. This passage says to me: I must first give to God that which belongs to God. The New Testament clearly states that we ought to love our enemies. When Caesar demands that I should participate in activities contrary to God’s will, then it is my duty to put God first and resist Caesar.

When Jesus was walking and preaching in Galilee and up to Jerusalem, people believed in many gods. There were family gods, town/village gods, and other local gods. But the greatest god was Caesar himself who was a god with temples, statues, and obligations to Roman imperial power – much like our reverence for the United States where we pledge allegiance and support with our taxes. In those days some Jews and early Christian got into trouble because they would not participate in the worship of that Caesar god.

With about fifty years of war tax resistance (WTR) activities, during which my life situation and the tax code has changed, I have had many experiences and I AM STILL ALIVE. When I talk to people about WTR, I find that many of them fear Caesar (the IRS) like an all-knowing, all-seeing god. The reality is that the IRS is a mess and the first rule in dealing with them is to make a copy of all documents you sent to them and take them with you when you visit their office since they probably can’t find a good number of them. Let me review some of my experiences.

In the Vietnam War, there was a 3% telephone tax to support that military aggression. At that point this was the main war tax I was required to pay – I resisted it. I did not feel that I should voluntarily pay for this war making and it was important for me to resist even if interest and penalties were added. After a few years, the Internal Revenue Service (IRS) placed a levy on my wages for $39 for resisted taxes, interest, and penalties. It is clear that it cost the IRS more than $39 to collect this tax so in a sense I took some additional funds from the war-making machine. I also kept exact records of my resisted telephone tax each month and my calculations were that at that point I owed them $84 in resisted telephone tax. In other words that almighty Caesar failed to collect about $50 that I owed. As my war tax resistance continued, I found that frequently they did not collect the amounts that they were legally entitled to. This meant that to some extent my resistance was financially successful in keeping the government from getting what they demanded from me.

I always gave away my resisted war taxes to life-enhancing organizations which, naturally, included many Quaker ones -- these organizations benefited from my resistance. One year, due to a quirk of life and the tax code, I resisted over $6,000 and gave it all to worthy organizations – usually it was more like $300 (in my early years) to $1500.

At times I had a regular salaried job and I resisted the war-related part of the taxes which in the 1970’s was about 33% for current and past wars as calculated by the War Resister League (www.warresisters.org) each year -- now it is closer to 50% as the American Empire has expanded at the expense of domestic needs.

For three years in a row, I was called in by the IRS for a tax audit. Since my income and tax returns were simple – I didn’t make that much money – this was no problem. I was told that this was a randomly generated audit, but then the only other tax resister I knew at that time in Pittsburgh, Marian Hahn, was always called in for an audit at the same time. The second year the agent I met with wanted to disallow one of my deductions which I was clearly entitled to. I filed for a hearing on the issue. The hearing lasted about 30 seconds since the IRS agent at the hearing immediately realized that I was correct. Then after the IRS audited me two years in a row with no change and wanted to audit me for the third year, I showed them the IRS regulation that they couldn’t audit me for the third year. I walked out of the office without being audited. I realized that the IRS did not have godlike qualities.

One year when I was audited, I went in and the IRS agent was clearly quite tense. As soon as I told her that I was a war tax resister, she relaxed. Since my letter on why I was resisting war taxes was not in my file, I had to give her my copy for her to duplicate for my IRS file. After she read it, she asked to be excused and went out of the room for about five minutes. She then came in and asked me if I would be willing to write a check to the Department of Health, Education, and Welfare in lieu of one to the IRS. I had ten seconds to think and made one of the greatest mistakes of my peacemaking career. I said, “No.” While this is illegal, I should have said “yes” to see what would have happened with my check and if it would have been credited to my tax liability. If this had worked, there never would have been the need for the National Campaign for a Peace Tax Fund for us war tax conscientious objectors.

About 1983 I was assessed a $500 frivolous fine for not paying the amount I owed and sending in a letter of explanation. When I told my ten year old son, Tommy, about this, his reaction was “You are going to lose.” I asked why and he replied, “The government pays the judges.” My case was taken up by the Pittsburgh ACLU, consolidated with similar cases in Philadelphia, went to court, and we all lost as Tommy predicted.

About this time I attended the organizing meeting for the National War Tax Resistance Coordinating Committee (NWTRCC) and was its treasurer for a number of years. It is a great organization for those resisting or considering resisting war taxes.

Later I realized that even if I paid some taxes to the IRS, they would still take 33% to 50% of what I paid for war-making. I sometimes lived below the taxable income, stopped filing, and worked as an independent contractor. My contact with the IRS then diminished considerably, although I would sometimes get letters from them in Spanish because I lived in a community outside of DC with many Latino neighbors.

I always paid my state taxes and gave away my resisted war taxes so that I received no private financial benefit from my resistance.

Now I live in Kenya and I am so below the taxable income that it is embarrassing. The taxable income for someone living overseas is in excess of $70,000, a fortune for my modest income and living standard. The IRS did attach a savings account for some back taxes they say I owed. Since the savings rate was .05% this amounted to about 25 cents per year (again costing them more to collect than they did collect). Nonetheless I closed the savings account. The IRS has also attached 15% of my social security benefits for a past tax liability – I do not know why. I have asked the IRS for an explanation, but they have never responded.

My resistance has not curtailed the expansion of the US military-industrial complex, but that is not why I am a war tax resister. I resist because I don’t want to participate in killing people, directly or indirectly. I have lived the life as I wanted to live without letting the IRS god determine my choices. Quaker simplicity has surely helped out a lot in my resistance.

Let me end with a joke, sort of. I was once at a NWTRCC meeting and a young couple of war tax resisters announced that they were getting married, but would have no children because they didn’t want their children to have to “suffer” from their war tax resistance. Wow, I didn’t realize that my kids might be suffering from my resistance. Fortunately for my children, they had already been born and I couldn’t put them back in the womb.

I don’t think my children, or even I myself, have suffered a bit because of my war tax resistance. In fact it has made me a more caring, compassionate person since I realized that I shouldn’t aspire to making a large income. It also keeps me aware that I was an outsider to the so-called “American Dream” as a non-participant in America’s war making that sustains American affluence. Moreover, there is no doubt that my involvement in peacemaking in East Africa is the flip side to my war tax resistance – I not only need to oppose militarism, but work to restore peace and reconciliation to places that have been beset by violence and war.

Related posts